Benefits of Solar for Not-For-Profits

Whether you are a faith-based organization, a charter school, a health care facility, a public school, an affordable housing complex, or any other non-profit you can benefit from going solar.

All not-for-profit entities use electricity, but they don’t pay income taxes. Non-profits may struggle to pay out these high monthly utility bills.

For-profit businesses are can take advantage of solar energy tax savings to cut these costs, but non-profits have a harder time justifying the investment. With no income tax liability, non-profits are not able to take advantage of the tax benefits of going solar. Additionally, finding funding to finance the project can be difficult and can distract from other fundraising missions, however harnessing solar energy can cut large costs to the bottom line.

Benefits of Solar for Not-For-Profits

Benefits of Solar for Not-For-Profits

Solar can help you eliminate or reduce this monthly expense of electricity. If your organization opts for solar ownership, it could generate free electricity for decades after the initial investment is paid off. The warranty for solar equipment is 25 years but solar panels are extremely reliable and some are still producing after 50 years.

If making the upfront investment required for solar ownership is not practical for your business, you still have options through third-party ownership. With Power Purchase Agreements (PPAs), you can reduce your electric rates and start saving on day one with little to no money invested upfront. One specific $0 down financing method for nonprofits is a pre-paid PPA (Power Purchase Agreement). This means that 25 years of power is prepaid at a hugely discounted rate and we work with Ygene on these for the $0 down financing for the PPA.

Also prepaid PPAs via Zero Down Solar Inc, will refund approx half of the ITC rate back to the customer, so this is a good way for non-profits to avail of approx half of the ITC funds available to for profits!

Primary vs. Third-Party Solar Ownership

One of the biggest deterrents for nonprofits looking to go solar is financing. When it comes down to it, you have two major options: primary ownership and third-party ownership.

Primary Ownership

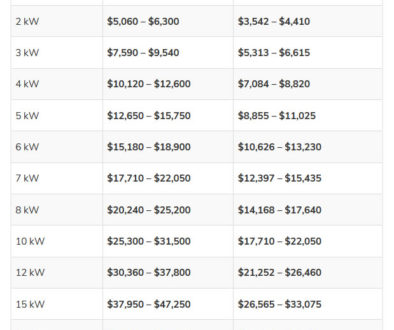

Primary ownership is when the non-profit pays for the complete upfront cost of the solar project, whether through out-of-pocket cash or loans. They are responsible for the system and any maintenance or repairs (though these should be minimal and often covered under warranties). The owners will also receive all the financial benefits (like SREC income if available in your state and all the electricity savings). In addition, you’ll be investing in a tangible asset that will increase the value of your property. The challenge for non-profits is that the significant tax benefits which help justify going solar are not available to them because they don’t pay taxes.

Third-Party Ownership

Third-party ownership is a popular choice for many non-profits because of the tax issue. If you’re looking to lower your electric bill but don’t want to make the large, upfront investment, and cannot use the tax incentives, then power purchase agreements (PPA) often offer no-money-down options. We have numerous $0 down financing opportunities.

Instead of owning the system yourself, an investor will pay for and have the system installed. You’ll buy back the electricity generated by the system at a reduced rate from the investor. Basically, instead of paying your utility electric bill, you’ll be paying the investor/owner of the system. This electricity is typically less expensive than utility electric because the investor will be taking advantage of the tax incentives, and some offer a fixed-price plan that keeps you safe from rising electricity rates.

However, you’re agreeing to make these payments for the length of the contract, which could be up to 20-25 years. Unlike owning solar, the third-party owner will be responsible for service and maintenance of the system. But this means that they will have full access to your roof during the PPA. PPAs have replaced leases as an option and the key difference is that with a PPA, the customer has the option to buy the solar system after, in our case, 6 years.

A creative and engaging way some non-profits have executed third-party ownership is through their donors. If your donors set up an LLC to purchase the solar system, they’ll be able to use the 26% tax credit and depreciation to lower the installation costs. The LLC would then have a PPA with the non-profit which would then pay them for the electricity at a reduced rate, just as you would with any other third-party owner.

Non-Profit Solar Financing and Incentives

One of the most significant incentives for primary ownership is the Solar Investment Tax Credit (ITC) offered by the federal government. It gives 26% of the solar installation cost back to the project owner in the form of a tax credit (in 2021 it will be 22%). But if you’re a non-profit, you don’t have tax liability and you won’t be able to take advantage of this incentive. However, there are still non-profit solar incentives and financing options available if you’re looking to install solar electricity. Our pre-paid PPAs will pay back half of the Investment Tax Credit, so at least non-profits can get something back.

State and Utility Rebates and Incentives

One source of financing that may be available to your organization is Property Assessed Clean Energy (PACE) financing. PACE programs offer financing for renewable energy projects and energy efficiency upgrades. Depending on the program, non-profits may be able to take advantage of this financing. Learn more here: https://zerodownsolar.energy/not-for-profit-organizations/

Whether it’s to slash your operating costs, reduce your carbon footprint, or a little bit of both, installing solar panels for non-profit organizations can be a great way to get your company recognized and super-charge your mission. Whether Residential, Commercial or Non-profit, that ZDS specializes in finding solar solutions which will immediately improve cash flow. In other words there is zero upfront cost, and the monthly payments will be less than paying SDGE.